Raymond Share Price: What’s Happening with Raymond Shares?

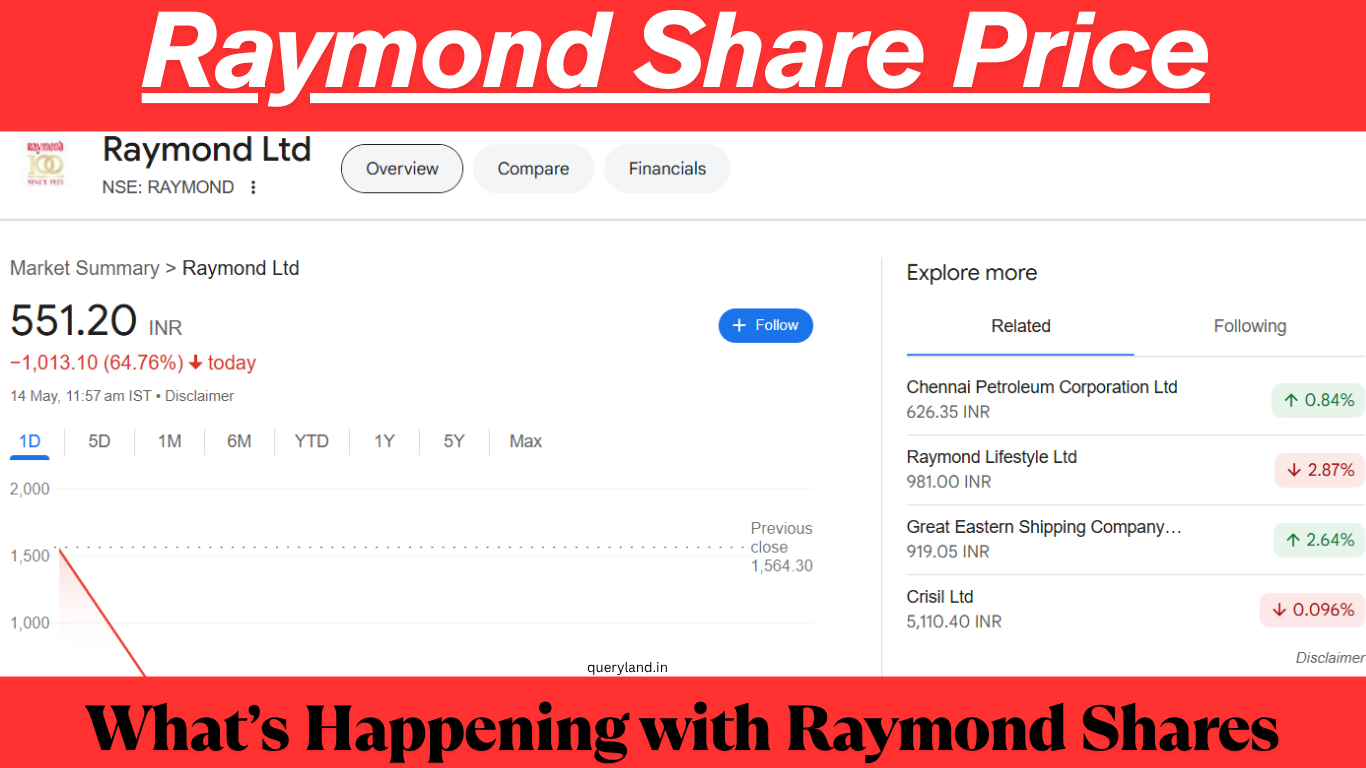

If you’ve been tracking the Raymond share price, you might have noticed recent fluctuations. Many investors are wondering, “Why is Raymond share price falling?” In this blog, we’ll break down the latest updates, news, and the impact of the Raymond demerger on its share performance.

What is Happening with Raymond Shares?

Raymond, a well-known Indian textile and apparel company, has seen a lot of movement in its stock price recently. The primary reason for this volatility is the announcement of a major corporate restructuring — the Raymond demerger. This demerger aims to separate its core textile business from its real estate and engineering arms.

Why is this important for investors?

Demerger plans often create short-term uncertainty, even if they promise long-term benefits. Investors may sell their holdings due to unclear future valuations, leading to temporary dips in the Raymond share price.

Why is Raymond Share Price Falling?

There are several reasons why Raymond shares may be falling:

- Market reaction to demerger: Investors may be cautious about the company’s restructuring.

- Profit booking: After recent highs, some investors are booking profits.

- Weak market sentiment: Broader economic or market trends can also affect individual stocks.

However, it’s essential to note that these dips may be temporary. Long-term investors often look beyond short-term price movements.

Raymond Share News: What You Should Know

Recent Raymond share news highlights the company’s strategic focus on its branded apparel and real estate businesses. Analysts have mixed views, with some expecting value unlocking post-demerger, while others advise caution.

Is Raymond a Good Long-Term Investment?

Raymond has a strong legacy and diverse portfolio. If the demerger is executed well, it may help the company focus on its core strengths, which can benefit shareholders in the long run. However, investors should do their own research and consult with financial advisors.

Conclusion

To summarize:

- The Raymond share price is facing short-term pressure due to the demerger.

- Keep an eye on future announcements and financial results.

- Adding transition words like “however,” “meanwhile,” and “in conclusion” can help improve content readability (as we’ve done here).

Whether you’re an active trader or a long-term investor, understanding the reasons behind price movements and company news is essential. Stay updated with the latest Raymond share news to make informed decisions.